Monday, August 18, 2014

Wednesday, August 13, 2014

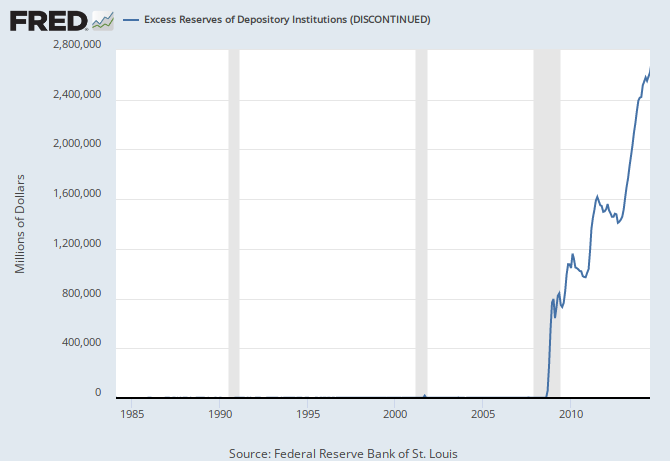

Excess Bank Reserves

There are currently upwards of $2.619 trillion of excess reserves held at the Fed by depository institutions. This is money that could be lent out by banks but isn't. Is this an explanation for the extremely low velocity of money? I'm sure it has something to do with it. Why aren't the banks lending?

What Does It Mean?

According to this graph from the Federal Reserve Bank of St. Louis, the velocity of the M2 money supply is lower than it has been for over 55 years at 1.531

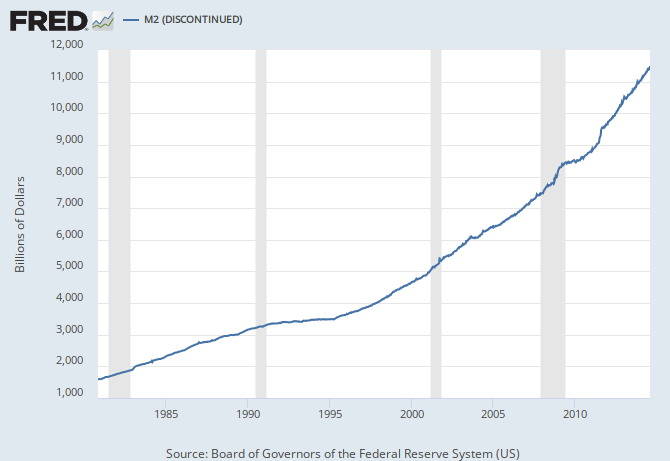

Meanwhile, the M2 money supply continues to grow at a fast pace. As of June 2014, the M2 was $11.3514 trillion (seasonally adjusted).

According to the Quantity Equation of Money

Money Supply x velocity = GDP deflator x real GDP

or

MV = PV

where V is velocity, P is the GDP deflator, and Y is real GDP.

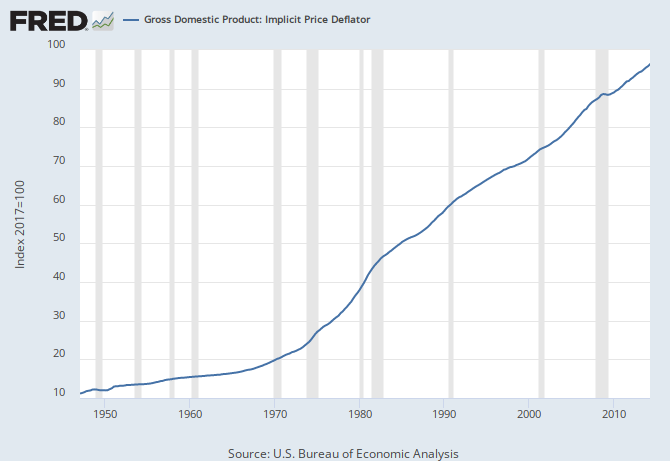

The implicit GDP deflator is 108.188 where Index 2009 = 100. In other words, the real GDP is in 2009 dollars.

As of the second quarter of 2014, the real GDP is $15.985.7 trillion.

PY would equal 1.08188 x 15.9857 or a nominal GDP of $17.2946 trillion

The MV side of the equation would be about $17.379 trillion, so the equation holds pretty much, allowing for rounding errors.

So why don't we have higher inflation despite the Fed "printing all that money?" The explanation must have something to do with the record low velocity of money. My investigation continues. Meanwhile there is a $17 trillion economy out there. Be grateful.

Subscribe to:

Posts (Atom)