Tuesday, June 16, 2015

Wednesday, June 10, 2015

Oil Prices Not Listening to Goldman Sachs Head of Commodities--Move Higher

Ole Hansen, head of commodity strategy at Saxo Bank has an explanation that may last at least until the Crude Oil Inventories number comes out at 9:30 central time.

https://www.tradingfloor.com/posts/crude-oil-soars-as-focus-switches-from-opec-to-the-us-5139337

Tuesday, June 09, 2015

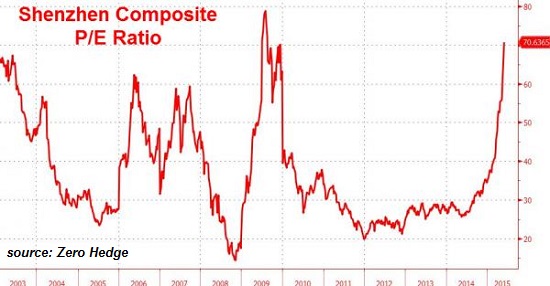

Shenzhen Market P/E Ratio 66--Classic Asset Bubble. Get ready for a correction

Bill Gross comments make news at Bloomberg.

http://www.bloomberg.com/news/articles/2015-06-04/bond-rout-not-enough-for-gross-as-china-stocks-seen-next-to-drop

Shenzhen Exchange Web Page

http://www.szse.cn/main/en/MarketStatistics/MarketOverview/

No way I know for Joe Blow to trade the Shenzhen Composite yet. But here are a handful of China ETFs to look at. EWH, FXI, ASHR, PEK, and CNXT.

Sunday, June 07, 2015

Goldman Forecasts Oil Price at $50 by year end

Jeff Currie ventured his year-end forecast of $50 after this week's OPEC meeting. West Texas Intermediate Crude spot price is currently $58.88. If he is right, there would be no rush to buy USO shares yet. The 30-week moving average and the current price are converging, but may not cross for several months if the oil price heads lower between now and the end of the year.

http://www.benzinga.com/media/cnbc/15/06/5573006/goldman-sachs-oil-will-be-at-45-in-october-and-50-by-year-end

Subscribe to:

Posts (Atom)